wake county nc tax deed sales

Our vast database is perfect for helping you find the best properties for you. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

Wake County NC currently has 19 tax liens available as of May 1.

. There are currently 1076 red-hot tax lien listings in Wake County NC. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Ad Find Tax Foreclosures Under Market Value in North Carolina.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wake County NC at tax lien auctions or online distressed asset sales. The Wake County sales tax rate is.

What is the sales tax rate in Wake County. Learn about listing and appraisal methods appeals and tax relief. Imposition of Excise Tax NCGS 105-22830a An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

View statistics parcel data and tax bill files. Foreclosures Tax Department Tax Department North Carolina December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government. The first step in the foreclosure process is advertisement of the delinquent account in The News Observer approximately two months after becoming delinquent.

This action is required by North Carolina General Statutes. According to state law the sale of North Carolina Tax Deeds are final and the winning. What is the Grande Ronde Cellars.

Sales and use tax rates other information sales and use tax rates effective. Search real estate and property tax bills. Sales are conducted on the courthouse steps at 200 North Grove St Hendersonville NC 28792.

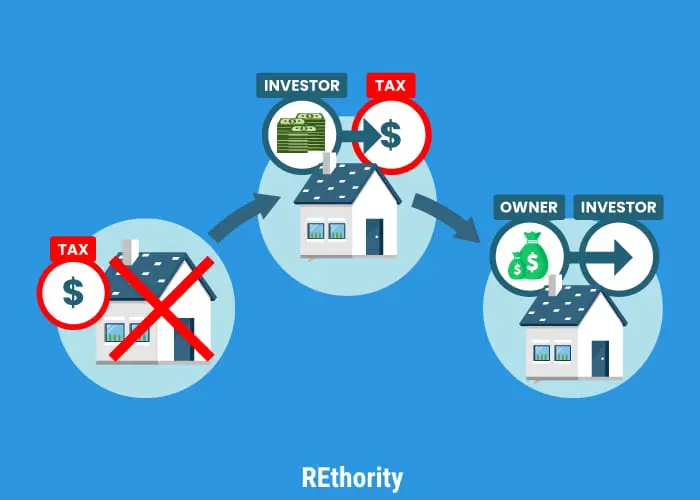

Complete List of Available Properties for the 2022 North Carolina Tax Deed Sales. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from. There is no mortgage tax in North Carolina.

Check your North Carolina tax liens rules. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Just remember each state has its own bidding process.

In North Carolina the tax collector or treasurer will sell tax deeds to the winning bidders at the delinquent property tax sales. The sale vests in the purchaser all right title and interest of Wake County in the property including all delinquent taxes which have become a lien since issuance of North Carolina tax deed. The North Carolina state sales tax rate is currently.

Wake County in North Carolina has a tax rate of 725 for 2022 this includes the. The full Wake County real estate file is available in the following formats. In North Carolina the County Tax Collector will sell Tax Deeds to winning bidders at the Wake County Tax Deeds sale.

Ownership sale information and property detail for all Wake County real estate parcels is available for download. If you do not see a tax lien in North Carolina NC or property that suits you at this time subscribe to our email alerts and we will update you. A Special 400 Offer from Tax Title Services to help you clear the title on your property.

Property Tax Collections Collections. Enjoy the pride of homeownership for less than it costs to rent before its too. Everyone is happy Wake County North Carolina recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of all liens including mortgages created prior.

These one-in-a-lifetime real estate deals are that good. The 2018 United States Supreme Court decision in South Dakota v. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

To see a list of upcoming tax foreclosure sales please visit the websites of the law firms conducting the sales. Pay tax bills online file business listings and gross receipts sales. Attachment of bank accounts rental income or income tax refunds.

No more than 100 acres of an owners land in a county may be classified under this program. 100 County Tax DepartmentsTax Department OfficesTax OfficesTax Collections Offices and Tax Collectors and 267 municipal City or Town Tax Collectors. The properties listed for sale are subject to change without notice.

The Henderson County Tax Collector is authorized to foreclose on real property for which delinquent property taxes remain unpaid. 87 rows 100 County Tax DepartmentsTax Department OfficesTax OfficesTax Collections Offices and. Wake county nc tax deed sales Sunday March 13 2022 Edit.

The wake county assessors office located in raleigh north carolina determines the value of all taxable property in wake county nc. The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the. Generally the minimum bid at an Wake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

The land must consist of at least 20 contiguous acres. This can be enforced by individuals. The average house price in Wake County NC is 39420500 but RealtyTrac can help you find Wake County NC foreclosure listings that fit your criteria for buying property at auction whether this is your first deal or youre a seasoned investor.

North Carolina General Statute NCGS 105-27715 allows a property tax deferral program for landowners who manage their land for wildlife conservation purposes. Everyone is happy wake county north carolina recovers lost tax revenue the purchaser. Commencement of any of these actions will result in additional costs andor fees being added to the unpaid bills.

The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal. Posted on December 23 2020 by December 23 2020 by. This is the total of state and county sales tax rates.

The relevant North Carolina statute is GS. Tax deed sales wake county nc. 75-1 the Unfair Trade Practice Act UTPA.

Exclusive access to our insiders newsletter with alerts for upcoming tax sales throughout the year. Common Issues Youll Want to Avoid After Your Purchase.

North Carolina Estate Tax Everything You Need To Know Smartasset

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

How To Find Tax Delinquent Properties In Your Area Rethority

Foreclosures Tax Department Tax Department North Carolina

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Wake County Register Of Deeds Fully Reopens To The Public For In Person Service Wake County Government

North Carolina Estate Tax Everything You Need To Know Smartasset

How To Find Tax Delinquent Properties In Your Area Rethority

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

How To Find Tax Delinquent Properties In Your Area Rethority

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

Foreclosures Tax Department Tax Department North Carolina

How To Find Tax Delinquent Properties In Your Area Rethority

Bladen County Property Tax Bladenonline Com

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

Foreclosures Tax Department Tax Department North Carolina

Full Article Preventing Evictions After Disasters The Role Of Landlord Tenant Law

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay